A handy nanny payslip guide

A handy nanny payslip guide

When you decided to become a nanny, you might not have thought about the details of being paid but I receive a lot of questions about pay and in particular pay slips. They can look very complicated, full of jargon and technical language, but I have worked in the childcare industry for a long time and have seen a lot of payslips, so I put together this handy payslip guide to help you.

What does a nanny payslip look like?

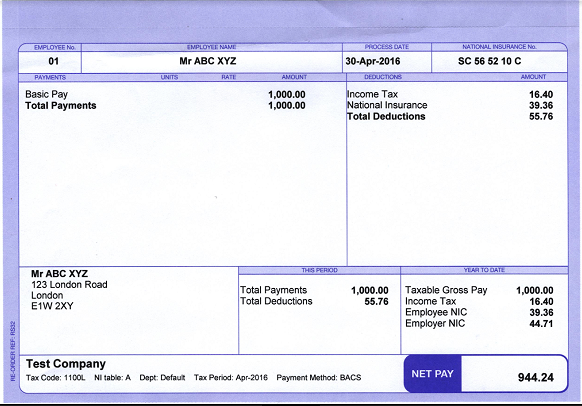

This is what a nanny payslip might look like – it seems very official and daunting but there’s lots of helpful information on it. This one is obviously a mocked-up version, but I’ll go through what each section means.

What does each section of a nanny’s payslip mean?

Let’s dive into the detail.

There is some obvious information included on here such as your name and address and your national insurance (N.I) number which you will have had to provide to your employer family. The process date is ‘pay day’ – when the net pay will be paid.

- Employee no. – signifies which of the family’s employees this payslip relates to – if the family only employs you then the number will always be 1; if they are like something from Downton Abbey then you may be one of a number of staff and so that number may be different!

- Basic Pay – this is your gross salary for the month. Gross meaning that no tax has been deducted; net is when the tax and any other deductions have been made.

- Deductions – this shows the income tax due and national insurance contributions that are being deducted at source (so before you receive any pay) from your salary. Other deductions that would feature here are pension contributions and any payment of a student loan. ‘Total deductions’ is the sum of all deductions.

- This period – This is a summary showing the gross pay and the total deductions for that pay period. (Gross pay minus total deductions gives the net salary figure.)

- Year to Date – HMRC’s tax year runs from 6 April to 5 April of the following year. This pay slip is dated 30 April 2016 so it’s right at the beginning of a new tax year. In this section, it’s showing the

- Total gross payments,

- Total tax paid by you the nanny, as well as your …

- Total national insurance contributions and

- The total NI contributions made by the employer, which they are required to pay for having a nanny.

It accumulates and so those numbers will grow each month until the start of the next tax year when it will start all over again.

- Net pay – the amount paid to the nanny on pay day.

- Test company – this would be the payroll company that your family are using to produce the pay slips and take care of all the tax deductions and NI contributions.

- Tax code – this is the tax code that you’re on. This year (2021) it’s 1257 and then a letter. All payslips show the tax code although it might be different if you’re in a nanny share situation or if you work for more than one family (if this is the case then each payslip’s tax code will add up to one complete tax code, as if you were working for one family).

- NI Table – this is the rate of national insurance that you pay.

- Tax period – this is the period of time you’ve been taxed for.

- Payment method – this is how you receive your salary. In this example and in most cases, it is BACS which means that your employer puts the money in your account so as you would do with any employer, you need to provide your bank details to your family.

This is all you need to know for a payslip that looks just like this one but, of course, there are variations – I hope it makes sense! Like I said, I receive a lot of queries on this topic so do have a read through and make sure you understand it all – if you don’t, feel free to give me a call 01732 838417.